Get in Control of Your Money — Without Doing It Alone

Money Buddies is a 4-month coaching program for singles who want to master their money with accountability, structure, and support.

-

-

Overview

Schedule

-

Learn how to be successful with this program

-

Week 2: Save Money Now

Let’s not wait to start saving you money. We’ll walk through a few main strategies to save money now.

Let’s not wait to start saving you money. We’ll walk through a few main strategies to save money now.

-

Week 3: Money Mindset

We will be examining all the financial influences you’ve had to this point, and what you want your new money story to be.

We will be examining all the financial influences you’ve had to this point, and what you want your new money story to be.

-

Week 3: Spending Postmortem

We will be examining your past spending in order to create a realistic first version of your plan.

We will be examining your past spending in order to create a realistic first version of your plan.

-

Week 4: Money Method

Let’s zoom out before we zoom in to your intentional spending plan.

We’ll talk:

-giving every dollar a job

-define zero-based budget

-discuss your financial order of operations

Let’s zoom out before we zoom in to your intentional spending plan.

We’ll talk:

-giving every dollar a job

-define zero-based budget

-discuss your financial order of operations

-

Week 4: Create Your Spending Plan

We will be creating your intentional spending plan!

Download YNAB

We will set up your budget line by line

We will discuss new habits needed to stay intentional with your new spending plan

We will be creating your intentional spending plan!

Download YNAB

We will set up your budget line by line

We will discuss new habits needed to stay intentional with your new spending plan

-

-

-

Week 1: True Expenses

True expenses are not only your monthly bills, but all the other things that are very real costs in your life like variable + nonmonthly expenses.

True expenses are not only your monthly bills, but all the other things that are very real costs in your life like variable + nonmonthly expenses.

-

Week 2: Wants vs Needs

What is a want? What is a need? Let’s define these so we can prioritize our money effectively and align our spending with our values.

What is a want? What is a need? Let’s define these so we can prioritize our money effectively and align our spending with our values.

-

Week 3: Emergency Fund

What is an emergency, and what is not? Let’s learn about savings, and also establishing guardrails with our emergency fund.

What is an emergency, and what is not? Let’s learn about savings, and also establishing guardrails with our emergency fund.

-

-

-

Lesson 1: Gathering & Finding Your Debts

Do you know how to find your debts? Let’s identify what information we’re looking for and where to find it.

Do you know how to find your debts? Let’s identify what information we’re looking for and where to find it.

-

Create your debt payoff plan using one of the two main methods.

-

Lesson 3: Expediting Debt Payoff

Find ways to pay off your debt even faster! Speed up the month and year you will become consumer debt-free.

Find ways to pay off your debt even faster! Speed up the month and year you will become consumer debt-free.

-

Lesson 4: Future Debt Prevention

Future debt prevention consists of:

Planning ahead for upcoming expenses

Planning for the unexpected

Planning for living your life

Understanding your spending triggers and identify new healthy responses

Establishing financial boundaries

Redefining your relationship with credit cards

Future debt prevention consists of:

Planning ahead for upcoming expenses

Planning for the unexpected

Planning for living your life

Understanding your spending triggers and identify new healthy responses

Establishing financial boundaries

Redefining your relationship with credit cards

-

-

-

Week 1: Money Psychology

These universal money psychology principles give us all a framework by which to work. If we put concepts to practice in deed and thought, we could improve our financial effectiveness.

These universal money psychology principles give us all a framework by which to work. If we put concepts to practice in deed and thought, we could improve our financial effectiveness.

-

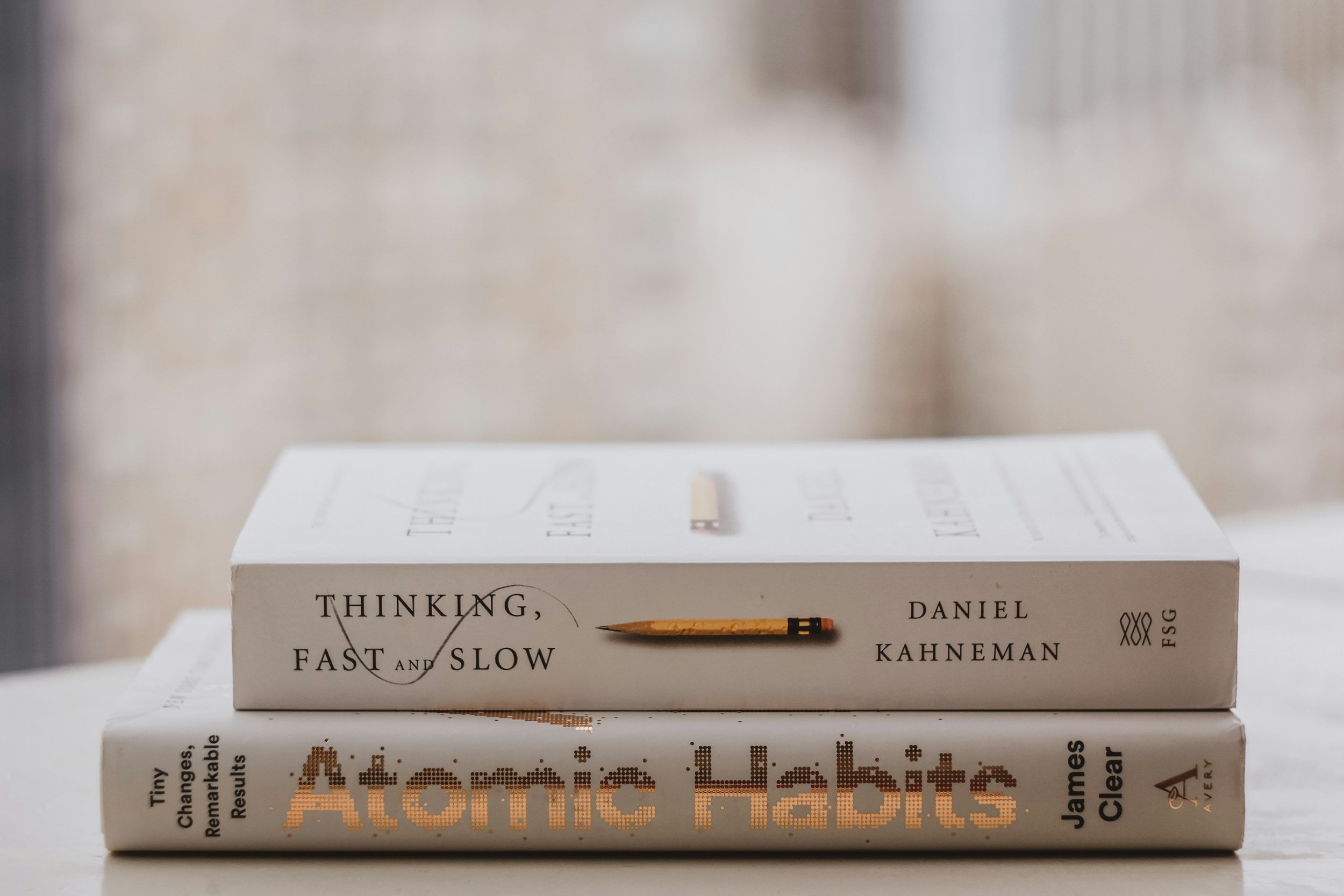

Week 2: Implementation Intention

James Clear’s concept of Implementation Intention is a powerful tool for making good habits stick. It involves creating a clear plan for when, where, and how you will take action. We apply this to personal finances to set us up for long term success.

James Clear’s concept of Implementation Intention is a powerful tool for making good habits stick. It involves creating a clear plan for when, where, and how you will take action. We apply this to personal finances to set us up for long term success.

-

Week 3: Reducing Friction

Reducing friction with our finances refers to making our new good habits easier to stick to. There are two main ways to do this: 1. delete and 2. automate.

Reducing friction with our finances refers to making our new good habits easier to stick to. There are two main ways to do this: 1. delete and 2. automate.

-

Week 4: Increasing Motivation

Motivation often comes after starting a new behavior, not before.

Motivation is often the result of ACTION, not the cause of it.

3 laws to consider

Defining your big WHY,

Setting clear goals, and

Getting ongoing accountability

Motivation often comes after starting a new behavior, not before.

Motivation is often the result of ACTION, not the cause of it.

3 laws to consider

Defining your big WHY,

Setting clear goals, and

Getting ongoing accountability

-

-

Meet your coach

✳

Meet your coach ✳

Hi, I’m Cortney!

I’ve been where you’re at with money: realizing that something needed to change, and deciding to do something about it.

For me, it started in 2013. I was newly married, and never really gave a second thought to me. If I had it, I spent it (happily). I had zero concept of saving.

A dear friend cared enough about me to give me a book on personal finance that changed my live (Dave Ramsey’s Complete Guide to Money) and the life of my family.

We learned how to become effective stewards of the money God had blessed us with, and paid off ~$145,000 of debt in 4 years 9 months.

We’ve been able to be generous to those around us, invest for the future, and spend money on fun things that we couldn’t do when we were in debt.

Now, I get to help others become intentional in their spending & saving so they have more freedom and options in life.

What you’ll learn

-

Become aware of where your money is going and understand your own money mindset.

-

Begin to take (small or big - that’s up to you!) steps to address your financial situation and goals.

-

Learn to sustain your actions through habit formation. We make the new habits easier to stick to and the old habits harder to fall into.

Course FAQ

-

Total per week: 35 minutes

30 mins per week on watching the program and working on action items

5 minutes per week checking in with coach on Marco Polo

On an ongoing basis, you’ll also want to keep your new plan updated. When done regularly, this takes seconds per day. The point is to stay intentional with your money all month long, and we do this by checking in with our plan and keeping it up to date.

-

Yes! We can use alternatives like Loom.com (free) especially if you want to record your screen to walk through your budget together. There is also a free app called Voxer we can use, or you can simply email me at cortney@nwmoneycoaching.com or send voice memos via text at 503-610-6751.

-

You are able to add on a one hour, 1:1 financial coaching session with me via Zoom depending on availability. Please reach out to me to set this up and discuss pricing.